Central Banks are in a Huge Bind

Look what happened when interest rates were slightly reduced

The Bank of Canada cut its rates by 25 basis points earlier this month, on the basis that inflation was falling. Here’s what happened:

Core CPI – goods and services less food and energy – spiked by 4.9% month-to-month annualized in May from April, the hottest since September 2022 (blue), according to Statistic Canada today.

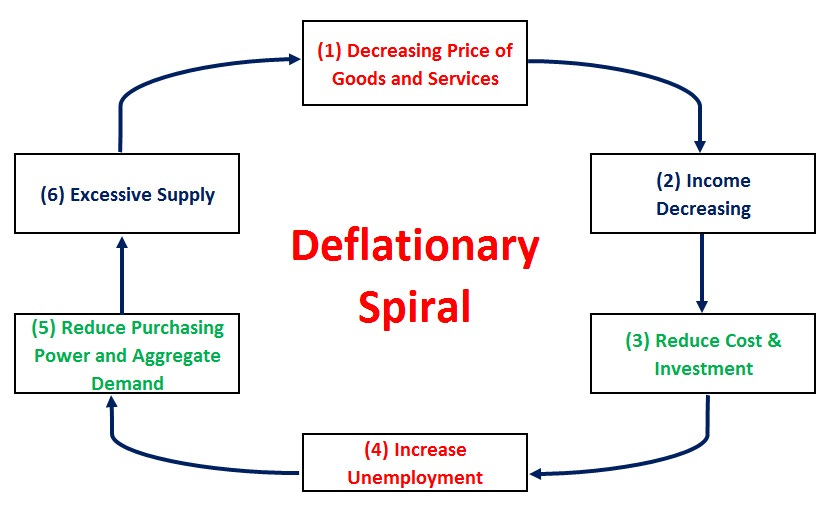

Clearly Central Banks risk triggering hyperinflation if they try to cut rates significantly. And with private and public debt at eye-watering levels across the world, maintaining or increasing rates to try to tame inflation will result in mass bankruptcies and ultimately send the global economy into a deflationary death spiral.

Imminent or late August -early September. Picking up pennies in front of a steam roller at this point.

https://t.me/EdwardDowdReal/842

Back sea shells?