A Prelude to Hyperinflation?

We're caught in a trap...

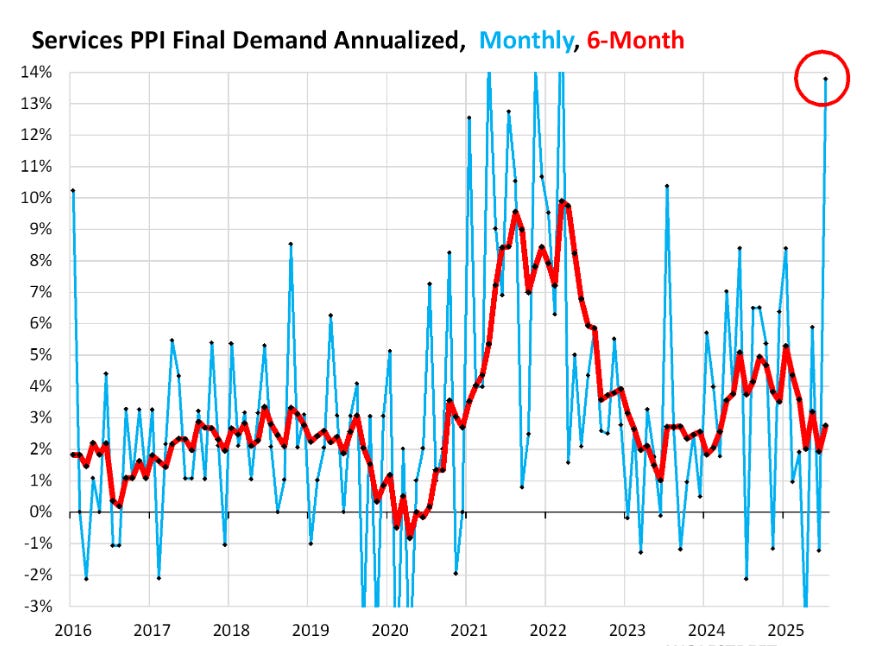

Core Services PPI Explodes, Worst since March 2020, Causes Overall PPI and Core PPI to Explode

Food prices also spiked. Energy prices surged due to diesel, jet fuel, and industrial electric power.

WASHINGTON (Reuters) -U.S. producer prices increased by the most in three years in July amid a surge in the costs of goods and services, suggesting a broad pickup in inflation was imminent, posing a dilemma for the Federal Reserve.

The stronger-than-expected producer inflation report from the Labor Department on Thursday followed data this week showing consumers paid higher prices for services like dental care and airline fares last month. There were also no signs of further labor market deterioration in early August.

"This is a kick in the teeth for anyone who thought that tariffs would not impact domestic prices in the United States economy," said Carl Weinberg, chief economist at High Frequency Economics. "This report is a strong validation of the Fed's wait-and-see stance on policy changes."

In another inflation shocker the Producer Price Index Final Demand for Services exploded by 1.08% in July from June (+13.8% annualized!), the worst since March 2022 when inflation was peaking

So here’s the thing….

In my role as prophet/messiah, I was a fair bit early on anticipating collapse and the ensuing cannibalism. Way way back at the turn of the century, my spider sense was tingling and I was wondering WTF was going on.

This:

The Beginning of the End

JUNE 13, 2003 - There is increasing evidence that massive economic stimulus — monetary, courtesy of the Federal Reserve, and fiscal, thanks to the president and supply-side minded lawmakers — is taking hold. The magnitude of the policy turnaround, which caps a constructive, multi-year reflation process, should overwhelm the economic negatives — including the drag from expensive oil and poor finances at the state- and local-government levels.

Expensive oil and its impact on other energy costs remains a concern.

The current level of U.S. monetary stimulus is massive. Real interest rates have fallen 5.2 percent from December 2000 to March 2003, reaching -1.2 percent. A swing of this magnitude may be historical.

An analogy would be loading up a very fine, healthy horse and setting out on a long trek. Well into the journey your horse begins to tire, but because you must arrive at your destination at a specific time, you beat the horse to force him to continue.

Eventually, despite flailing him, the poor fella begins to falter. Stopping and resting is not an option so you inject the horse with a large does of cocaine enervating your mount who actually begins to gallop.

This is essentially what Central Banks did when faced with mounting energy costs after the turn of the century. And the economy galloped along up until the GFC when it nearly died. Likewise your cocaine-fuelled horse will eventually collapse.

When he does, after a short respite, you need to make up time so you increase the dosage of cocaine and adding speed and meth to the mix. Your horse perks up and it’s off to the races again. He keeps on running for another 12+ years and when he falters at the end of 2019 you hit him with even more drugs.

However this time around, the horse no longer responds as anticipated. The horse begins to stagger around the track. The stimulants have poisoned him and he is slowly dying.

If you attempt to up the dosage and further stimulate him, he will at some point experience a catastrophic cardiac event, and collapse, dead on the track.

This is exactly the situation that Central Banks are facing this very minute. If they attempt to revive the dying global economy by reducing rates and injecting cash and credit, the result will be raging inflation as opposed to the hoped for growth. The stimulus is now a deadly poison.

Rachel knows this and that is why she is in tears. She knows that we are FUCKED.

Surely The Men Who Run the World will act to prevent the Gates of Hell from opening. Surely they must be considering the Final Act in UEP - the releasing of the cannisters any day now.

Amusingly, I had lunch with an old friend in Toronto the other day. He is one of those big swinging dick types (chauffer driven car) and he, like most of the barnyard animals, are completely unaware that we are about to be fed into a blast furnace. He referenced 20%+ returns on his stock holdings. Everything is awesome - in his world (he is the king of DelusiSTAN).

He did acknowledge the energy crisis in Europe but informed me that ‘when the Ukraine War ends, that will all get sorted out’ because the world is bursting with huge amounts of oil and gas. I listened but did not waste any of my precious pearls on the swine.

This will be me - when the Shit Hits the Fan. I am both fearful - and excited!

Fuck Everyone and Everything

This article was inspired by a recent discussion with a barnyard animal involving the dire situation in New Zealand. He remarked that I appeared to be pleased with the slow motion unravelling of that country.

Food prices were driven by a 38.9% acceleration in the cost of fresh and dry vegetables.

https://www.reuters.com/world/us/us-producer-inflation-heats-up-goods-services-prices-soar-2025-08-14/

Exxon mobile stated that without investments we will have 15 % annual decline in oil production until 2030. That means almost 18 % inflation in energy costs. We will see discretionary spending and related businesses vanish. And at some point, the pandemic of the jabbed, which seems to save the day. Amish way of living is th