In a number of countries, including the United States, inflation has been raging for the past couple of years. Central banks have attempted to fend off hyperinflation by raising interest rates. Not only is that not working as planned, authorities have been lying (as they usually do when things get really bad).

These are revised numbers out of the US month-to-month annualized (the MSM will bury these revisions in a deep dark corner so that only the very curious will find them - and they may be subject to further upwards revisions) :

October revised to +3.9% today, from the +3.2% reported a month ago

September revised to +4.9% today, from the 2.0% reported originally two months ago

August revised to +5.8% today in serial revisions from the originally reported 2.6% three months ago.

Philly Fed Finds All Jobs "Created" In Q2 Were Fake

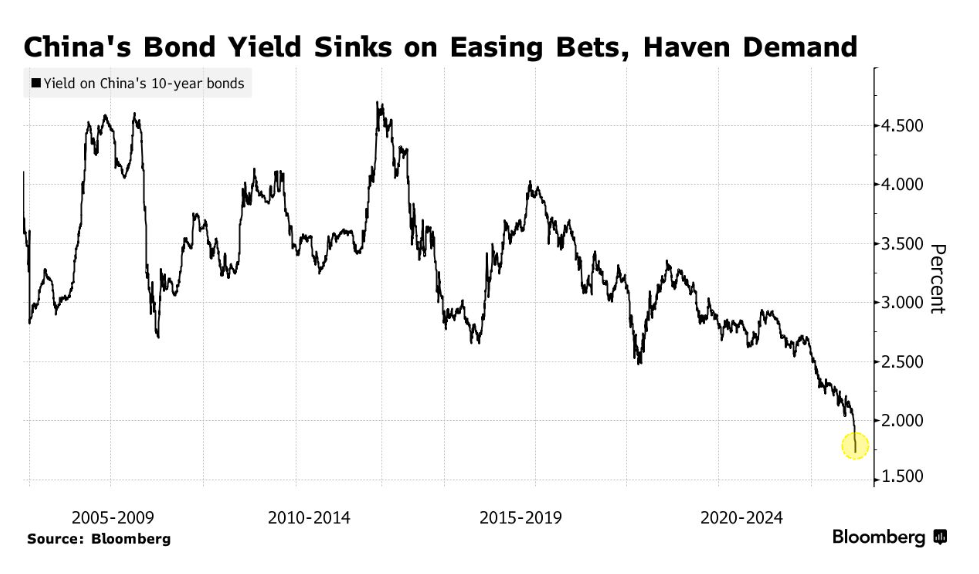

In this Tale of Two Economies, China is experiencing a far more dangerous problem, namely deflation.

Prices Won't Stop Falling in China, and Beijing Is Grasping for Solutions

Companies are pumping out goods amid falling prices, creating vicious cycle that is eroding confidence

The country that invented paper is making way too much of it.

So Shandong Chenming Paper, one of China’s biggest paper manufacturers, did what any company faced with overcapacity would do: It cut prices to unload more supply while it tried to ride out the storm.

Instead, its losses mounted. Last month, the company said it had racked up around $250 million in overdue debts. Creditors sued and some of the manufacturer’s bank accounts were frozen, it said.

The papermaker’s troubles are only the latest sign of the havoc caused by falling prices in China, as factories struggle to cope with overcapacity and weak demand.

Chinese leaders this week pledged to do more to stimulate the economy, including by cutting interest rates and boosting government borrowing. But pressure is building on Beijing to take even more forceful action to prevent a downward spiral of deflation that becomes self-reinforcing, potentially landing China in a longer-term recession.

Prices for goods leaving Chinese factories have fallen year-over-year for 26 consecutive months, dropping 2.5% in November from a year earlier, and there is little sign of them turning up again soon. China’s gross domestic product deflator, a broader gauge of price levels across the economy, has been in negative territory for six consecutive quarters, the longest stretch since the late 1990s.

The fear is that deflation is becoming ingrained in China. As falling prices sap profitability, companies could postpone investments or shed workers, leading more people to cut back on spending. Others might put off purchases because they think prices will drop even more.

“It becomes a vicious cycle,” said Penelope Prime, founding director of the China Research Center, an Atlanta-based think tank.

This week, China’s 24-man Politburo said it would implement more proactive fiscal policy and adopt a “moderately loose” monetary policy next year—the first introduction of such language since 2008. The leaders also vowed to boost domestic demand and stabilize the housing market, which some economists have said is needed to reignite inflation.

At Shandong Chenming Paper bosses wound up shutting down nearly three-quarters of the manufacturer’s production capacity. The company didn’t respond to a request for comment.

Other companies have kept cranking out more. China’s output of paper and paperboard year to date through October is up about 10% from the same period last year, according to China’s National Bureau of Statistics. Prices for paper products leaving Chinese factories have been dropping year-over-year since October 2022.

Other industries have followed a similar pattern. William Li, chief executive of Chinese electric-car company NIO, said on a call with analysts in September that makers of internal-combustion-engine vehicles in China have entered an “unsustainable cycle or a vicious cycle” of price cutting, hurting profits. Vehicle production in China continues to rise.

The problem is that once expectations for lower prices become entrenched, it is hard to turn them around. “The longer deflation lasts, it becomes entrenched into people’s expectations about future economic prospects,” said Eswar Prasad, professor of trade policy at Cornell University and a former head of the International Monetary Fund’s China division. “It becomes harder and harder to use macroeconomic stimulus.”

Lisa Wang, a salesperson at a textile manufacturer in China’s Zhejiang province, said new tariffs under Trump could add more pressure. Her factory has already had to cut prices to compete with the many other factories that make similar bedding products, eating into profits and forcing it to cut its workforce from about 600 people before the Covid-19 pandemic to about 400 today.

She said her company is trying to develop new products in categories that aren’t as saturated, such as a blanket using a fabric that feels cool to the touch, to try to attract more clients, including new Chinese buyers. Her current customers are mostly foreign.

With Trump’s potential tariffs still up in the air, she said the company is taking it one step at a time.

“It will be very hard for us,” she said. Source

China's Unexpected Retail Slowdown Shows Urgency to Boost Demand

Related

China: 120,000,000 Unfinished Homes

The Chinese Economy is Crumbling

Canadian Chinese Policemen Enjoyed Beating Hong Kong Students

I am concerned that my Outback Bucket List trip in May June... might not happen

https://mishtalk.com/economics/chinas-10-year-bond-yield-hits-new-record-low-on-disappointing-data/

Let's go Fed Let's go!

Do they have any more tricks up their sleeve... or is the detonation about to happen?

https://fasteddynz.substack.com/p/the-ultimate-extinction-plan-uep

A lot of us, if not most of us, have all the luck..

I always knew the world would end when my small business finally became profitable..lol.