The UK is heading for a full-blown financial crash

Public spending is out of control - and unstoppable

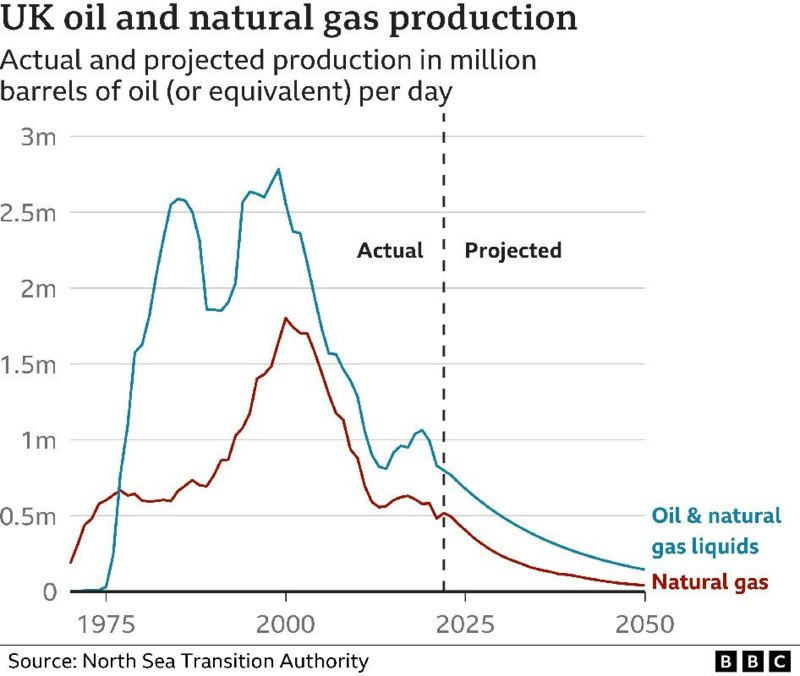

Of course it is unstoppable — the North Sea oil fields have collapsed and the UK no longer has access to affordable energy. The ‘solution’ is to offset expensive energy costs with debt.

The UK is a key pillar of the global economy. Find out what happens when a key pillar ruptures here.

Would you prefer :

a) Murder, Rape, Disease, Starvation and Cannibalism

or

b) To die relatively peacefully.

Actually the choice has already been made for you because humans are stupid and inevitably most would believe they could survive collapse of civilization and they’d do whatever it takes - including eating each other.

I’d like to take this opportunity to thank the Vaxxers for ensuring that our extinction will orderly and involve minimal suffering

During a discussion of collapse with a circus animal who is involved in the world of finance, I said I’d rather just swallow Fentanyl when things unravel. He objected and insisted that he’d rather go down fighting. As would most I said which is why I’d prefer to check out before the mass murder begins.

The UK is heading for a full-blown financial crash, and nothing can stop it now

Rachel Reeves has utterly lost control of public spending and is putting the economy in peril

She would never “play fast and loose” with the public finances. She would bring back “stability” and allow businesses to plan for the long term. Her formidable experience as an economist meant she would keep an iron grip on spending.

The Chancellor Rachel Reeves spent a lot of time boasting about how she would keep the books in order. And yet today’s horrific public borrowing figures make one point perfectly clear. She has completely lost control of public spending – and the British economy will be heading for a crash far sooner than anyone realises.

With Donald Trump softening his stance on Chinese tariffs, and ruling out firing the chairman of the Federal Reserve, the financial markets were in an optimistic mood this morning. Even so, the news out of the UK was still deeply disappointing. The Office for National Statistics revealed that the UK borrowed £15 billion more than forecast in the year to March.

In total, we borrowed a shocking £151.9 billion over the last twelve months, £20 billion more than the previous year, and much more than the Office for Budget Responsibility had forecast. Last month alone, we racked up another £16.4 billion in debt, the third highest March figure since records began.

In reality, the turmoil triggered earlier this month by Trump’s tariffs had obscured how precarious the UK’s financial position had become – and how rapidly the position is now deteriorating. The borrowing figures are getting relentlessly worse month-by-month.

It is not hard to work out why. The huge pay settlements for the public sector agreed by the Government over its first few weeks in office have driven up wage bills and added billions to the public sector payroll. Departments, led by Ed Miliband’s deranged green energy empire, have been spending far more than they were meant to. Local authorities have been left to pick up the welfare bills for the surge in asylum seekers.

Meanwhile, in a stagnant economy, corporation tax revenues have proved disappointing as companies struggle to make any money. VAT is no longer raising the amount expected as struggling households rein back their spending. Even worse, these are only the “provisional” figures. If anyone feels like a bet, here is a certain winner. When the final numbers are tallied up, they will be far worse.

The borrowing numbers are only going to go higher over the course of the summer. The huge rise in National Insurance charges will hit the public sector as hard as any private sector employer; it will add hundreds of millions to the cost of employing the 6.1 million people who work for the Government.

Businesses are already laying off staff and closing units – look at the decision by Morrisons to close 52 cafes and 17 convenience stores as a typical example of what is happening right across the country – to save on costs, and this will hit income tax and VAT revenues.

In reality, this can’t continue for much longer. As the ONS made clear today, the UK last year borrowed 5.3 per cent of GDP, an unprecedented figure at a time when the economy was performing perfectly well (at least until Reeves took over), and there was no immediate crisis to contend with.

The real figure may well be 6 per cent already, and it will certainly hit that level before the autumn. So far Reeves has only announced welfare cuts that will prove mostly fictitious, and “savings’” that won’t be delivered.

She has ruled out tax rises in the autumn, and may find that little more can be squeezed out of an exhausted economy even if she tries. Meanwhile, she is letting ministers and civil servants carry on spending as if budgets no longer mattered. The blunt truth is this: Reeves has completely lost control. The UK is heading for a full-blown financial crash – and nothing can stop it now.

I don't give a shit whether I die from fentanyl, gun shot wounds, or slowly starve. I would hate to die from old age or some natural cause and just wither away. As long as I can kill as many lawyers (and some doctors) before I go, I'd still have some purpose to my life, now that I'm 70 and a useless eater. It is my seething, intense hatred for lawyers (and several of my former medical colleagues) that drives me. But I'll be sure to save one round of my 20,000 stash from 22LR to 50BMG.

Green energy keeps on giving; you can now be charged up to 39 cents/euro's/whatevers for electricity you generate from your solar and sent to grid!

Green energy for those still green behind/between the ears!

'The regulator also found that 11 unnamed energy suppliers charge households with rooftop solar panels more to return excess electricity to the grid than they pay for the electricity generated, resulting in a net-negative feed-in compensation fee. While not prohibited under Dutch law, such pricing is only allowed if it does not lead to unreasonable costs.'

https://www.pv-magazine.com/2025/03/14/dutch-regulator-launches-probe-into-home-solar-feed-in-costs-compensation/#:~:text=Feed%2Din%20costs%20for%20households,customers%2C%20but%20prohibits%20unreasonable%20pricing

Can it get any better!!