Take the Fast Eddy Challenge

And an update from the End of the World Aussie Outback Adventure

Once upon a time after reading Tim Morgan’s The Perfect Storm, I realized we were fucked and the reptilian part of my brain overrode all logic activating Mr DNA who demanded that I do something. Mr DNA ultimately runs the show in each and every animal and when his host is threatened, he leaps into action.

The coming end of affordable oil and the resultant end of civilization as explained in Morgan’s long paper got the attention of Mr DNA and in robot-like fashion I obeyed his command to doomsday prep. After a few years of stockpiling and gardening cracks began to form in my certainty that this path guaranteed salvation.

I was living in Bali, Indonesia at my somewhat extravagant bolthole when a lengthy power outage struck. No internet, no lights, and refrigerated food was starting to go off when it hit me like a diamond bullet in the forehead - this is only temporary yet it is extremely alarming. When civilization collapses power will go off - permanently and I’d be on my own. I began to have doubts and questioned if what I was doing would be enough.

Logic began to push back against Mr DNA and it occurred to me that none of my neighbours had a plan in place for when the super markets empty of food. Some of them farmed rice but none were using organic methods. Without petrochemical fertilizers there would be no crops.

I know, I’ll pay the NGO that helped us set up our organic operation to train my neighbours - I will even purchase organic seeds for them. We put the word out and were met with a wall of silence. Not a single neighour was interested in my offer.

It was then that I knew what I was doing was futile. When the supermarket shelves empty, my neighbours would be turning their attention to my large organic gardens, and they’d not respond politely to ‘sorry there’s not enough for you.’

Soon after this I also realize that there were 4000 spent fuel ponds around the planet that would spew cancer-causing toxins globally that would persist for thousands of years.

I concluded that I had wasted huge amounts of time and money pursuing this idiotic idea. I realized that doomsday prepping was futile and I instead accelerated my bucket listing itinerary.

For those of you who are wasting what little time remains and spending all your cash on guns, ammo, seeds, and spare parts, I urge you to take the Fast Eddy Challenge.

For one month do the following - think of it as a dry run for what comes when civilization collapses (now’s the time to identify weak spots in your plan because the hardware stores are still operational):

use no electricity

use not petrol, gas or diesel (you cannot drive or use any machinery)

buy nothing

eat only what you grow (no cheating with stored food because that won’t be available post collapse)

take no medicines - this applies to your farm animals

fell enough trees and split and pile enough wood for a full year (all by hand no cheating with a chainsaw)

wash your clothes by hand (remember no electricity no washing machines)

Fortunately during your month, you do not have to worry about starving neighbours attacking you, ripping up your garden and killing your animals. You also do not have to deal with the aftermath of the spent fuel ponds.

I’ve put the Fast Eddy Challenge in front of preppers dozens of times over the years - not a single one has taken me up.

They, as do I, know why. To do so would burst their delusional perception of the tranquil, wonderful world of the doomsday prepper that has been fed to them by the Tee Vee. Taking the challenge would shatter their utopia and crash them into despair.

At the end of the day, humans need hope. When there is none they will grasp at whatever nonsense is offered to them. For some it’s the greatest marketing campaign ever, otherwise know as religion, huge numbers get played by the Three Pillars of Bullshit, and many get captured by doomsday prepping.

Anything, no matter how illogical, is better than the cold hard truth of what actually will happen when the global economy collapses due to the depletion of affordable energy.

In other news…

NZ is trying to spin a disastrous situation into a nothing burger.

What 'running out' supply means for households still using gas

Reports that New Zealand's natural gas reserves might be dwindling faster than expected may be unwelcome news to households using it to cook and heat.

The Ministry of Business, Innovation and Employment said previous forecasts showed annual gas production falling below 100 petajoules (PJ) by 2029, but revised forecasts indicated that level would be reached by next year.

Paul Fuge, general manager at Consumer NZ's Powerswitch, said residential gas use was only about 4 percent of the country's total gas consumption, so gas supplies for households probably would not run out, but he said they would likely become more expensive over time.

End of the World Bucket List Trip Update:

I shifted to another campsite yesterday for a 3 night stay and shortly after my arrival two barnyard animals parked up nearby dragging caravans the size of small homes.

One of them pulled an electric chain saw from the bowels of his house on wheels and sliced up some wood for their evening fire (apparently a hatchet would not be good enough). Yesterday, one of the fucking idiots runs a generator for most of the afternoon to charge his batteries so the wife can no doubt have enough battery juice to operate her curling iron, blender and pizza oven while watching re-runs of Dancing with Stars on the Tee Vee refuelling her Plough Hog arse with sacks of Doritos and Diet Coke. And today the other moron flicked on his generator at 10am and it’s been running non-stop for nearly 3 hours.

I understand that humans are extremely smart but that they cannot survive a day in the bush without being tethered to tech (says the guy with the Star Link, fridge, and 4 x 4) but I thought the point of camping was to rough it, at least a little.

If you can’t run it off a couple of solar panels (it has been full sun every single day since I left Perth 2 weeks ago) then fuck off and park your monstrosity in the supermarket carpark and run your contraptions 24/7. Put on some audio of waves lapping against the shore and birds chirping and pretend you are in the bush.

The thing is… most camp grounds allow this nonsense because so many of the barnyard animals are hauling giant rigs and they demand it. This makes it next to impossible to escape the morons.

This demonstrates just how dramatically divorced we are from nature. It’s gotten to the point where most people who are interested in nature will only engage with the wild if they can be guaranteed ice cold beer, unlimited electricity, and a king sized bed in a climate controlled caravan.

Here’s hoping that one of the big sows I see basting themselves on the beach get into the water and get hauled off by a tiger shark. I’ll be sure to smile as I capture that on my camera.

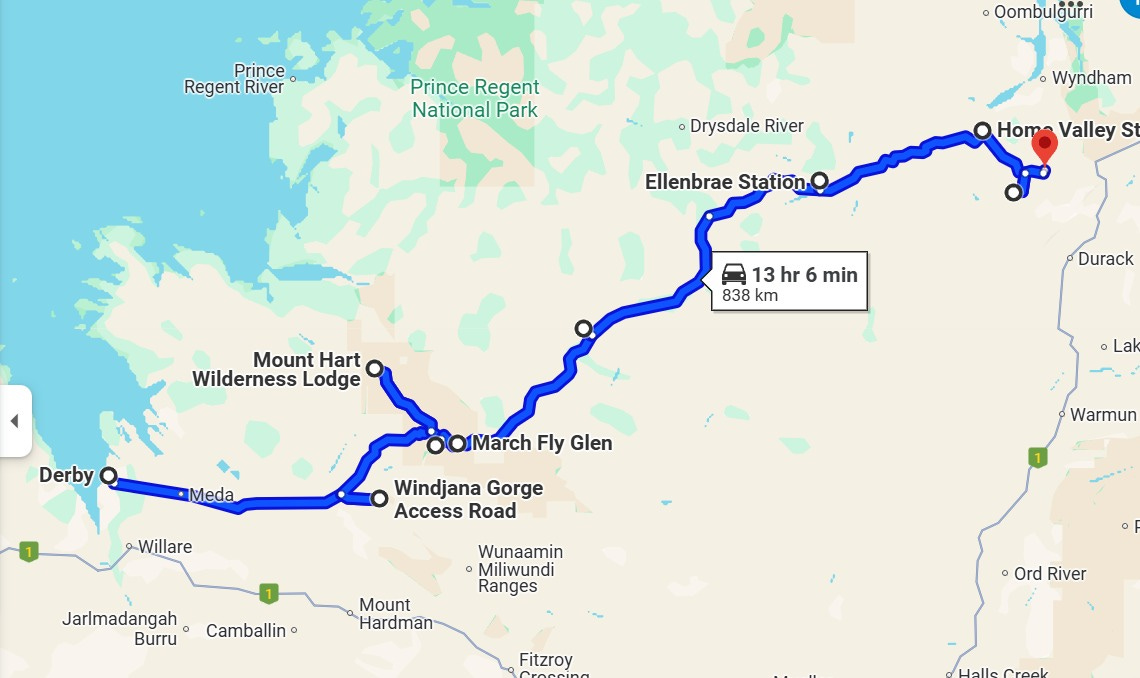

The Gibb River Road and tributary tracks are now mostly open to high clearance 4WD vehicles - only the Mitchell Plateau road remains closed. Into the Wild I shall venture on the coming weekend.

The GOP passage of $9.4 billion of DOGE cuts is nothing more than a PR stunt to convince the ignorant masses they are actually doing something about the deficit. The dopes making bets on Draft Kings and posting videos on Instagram have no concept about how ridiculously out of control our government has become. They add $6 billion to the national debt every single day, so their $9.4 of “cuts” will be gone in 37 hours. Our deficits are big, but they are not beautiful. Our deficit in FY24 was $1.8 trillion. Through the first 7 months of FY25 the deficit is $1.049 trillion. At the current rate of spending, the deficit will be $2.2 trillion by the end of the fiscal year.

Interest on the national debt is now the second biggest expenditure and has gone from $500 billion during Trump’s first term to $1.3 trillion today. These deficits are clearly unsustainable, and anything which is unsustainable will not be sustained. But the corrupt, captured politicians and insatiably avaricious Wall Street bankers will keep dancing until the music stops. Then they will use their next engineered financial crisis to take more of our money and further restrict our liberties and freedom. CBDCs and social credit scores anyone?

The real reason Trump and the GOP need to pass the big beautiful, bloated pig of a bill is because our Ponzi scheme economy depends upon the never-ending issuance of trillions in debt every year to give the fabricated appearance of stability. This is why the GOP applauds Musk’s low hanging fruit DOGE cost savings and ignores them in their outrageously corpulent budget bill. The truth is any actual reduction in government spending (36% of GDP) would ripple through an economy entirely dependent upon government largess and immediately create a massive recession and probable depression.

Ponzi schemes have to keep growing until they run out of suckers believing the bullshit underlying the Ponzi. This is where those controlling the levers of society (Bernays’ invisible government) utilize their limitless well of propaganda techniques, technological distractions, and mindless entertainment venues to keep the ignorant masses amused, delusional, and living in denial of the reality staring them in the face.

Since the 2008 financial crisis we have been muddling through economically at a 10,000 feet macro level, with periodic crisis episodes (housing collapse, fake pandemic) utilized by the powers that be to issue trillions more debt as the antidote to the initial crisis created by too much debt. At a micro level, the average American has seen a significant decline in their standard of living, as official government reported inflation has eroded 40% of their purchasing power, when in reality they have lost more than 60% of their purchasing power. The reality for the average American prole is debt slavery, either self-imposed to keep up with the Joneses or forced upon them to survive this globalist-imposed death by a thousand cuts economy.

Credit card debt of $1.3 trillion is at an all-time high, up $350 billion (35%) since 2020. The average balance on those credit cards is over $7,000 and the average interest rate on those unpaid balances is over 21%. Student loan debt of $1.8 trillion is at an all-time high, up $100 billion since 2020, with over 25% of these loans in default. Auto loan debt of $1.7 trillion is at an all-time high, up $350 billion (27%) since 2020. The average length of these loans is now 70 months. The borrower is underwater by the fifth year of these loans. Shockingly, credit card and auto loan delinquencies have been soaring in the last year, with credit card delinquencies above 3% for the first time since 2012, and auto loan delinquencies surpassed 8% for the first time since 2010. Does that sound like a consumer on solid ground?

In addition, the housing market is a disaster looking for a trigger. The Wall Street hedge funds (Blackrock) bought up millions of homes, driving prices 140% (Case Siller Index) higher than the 2012 low, while outstanding mortgage debt has risen from the 2012 low of $13 trillion to $21 trillion today. Prices are ridiculously high and mortgage rates of 7% make it virtually impossible for an average working stiff to buy even a small home. The market is frozen.

This is why Trump and his GOP minions must avoid a recession at all costs by continuing to rack up $2 trillion annual deficits. A recession would result in millions of layoffs, which would mean unpaid mortgages, which would mean foreclosures and slashing of home prices, which would trigger housing collapse 2.0, which would turn the recession into a depression, causing a stock market collapse. Now you know why they are desperate to pass this big, beautiful behemoth of bilge.

The Fed is in a precarious position of their own making, with all choices pointing towards disastrous outcomes. They are already sitting on over $1 trillion of unrealized bond losses, while their Wall Street owners sit on another $400 billion of unrealized bond losses. If these entities ever have to realize those losses, our entire banking system would collapse. The Fed has cut rates by 1%, but market rates went up, as their power to mislead market players diminishes.

They have reduced their balance sheet from $9 trillion to $6.7 trillion. The last time they tried to reduce their balance sheet in 2019, the repo market spasmed and they used the Covid cover to drastically print more fiat. Trump is mocking Powell and demanding interest rate cuts. Powell is pretending to be independent, but he is praying for some kind of crisis to again set the printing presses to hyper-speed. I’m sure the ruling oligarchs are hatching a new crisis to expand their wealth, power, and control, while further impoverishing and enslaving the plebs.

https://www.zerohedge.com/geopolitical/we-are-being-amused-abused-death

No Hoolio pic? Booo...

I hope he's fine. :D